This article is intended to assist you in understanding your payslip and how each item is calculated.

In the interests of transparency, we have included all amounts received into Brookson, amounts we are required to retain in order to comply with our legal obligations as your employer, as well as deductions we are obliged to make from your gross pay before sending payment to your nominated bank account.

There is also a page 2 to the payslip which will further break down hours worked and rate of pay – so will provide a comprehensive view of your pay from your employment.

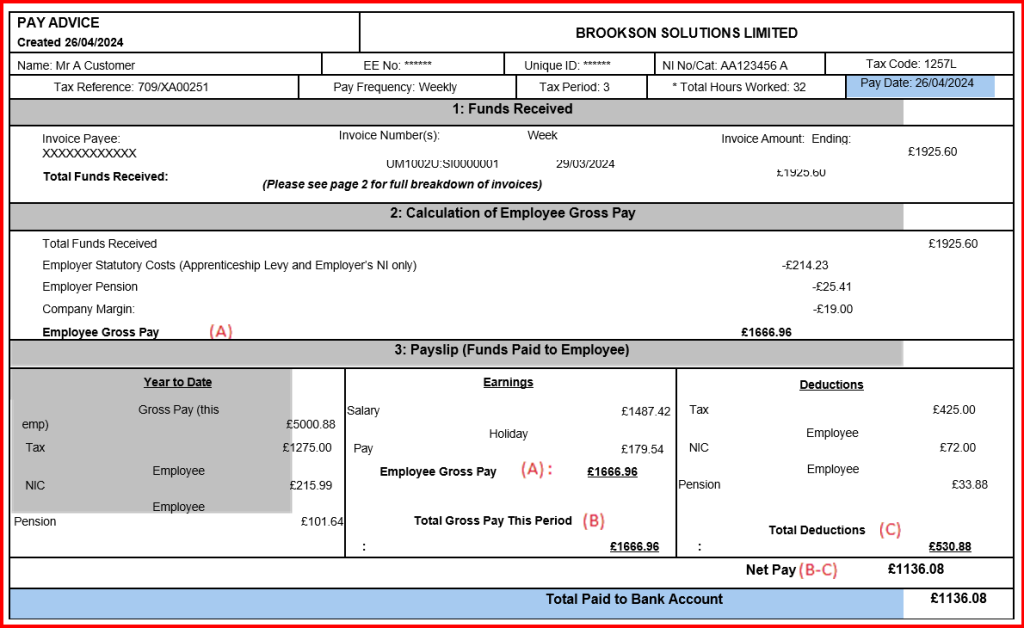

An example of this document is shown below and is referenced to the guidance notes

1. Invoices paid to Brookson

This is a summary of invoices making up your payment in this period. For a full breakdown including hours worked and rates of pay please see page 2.

Please note that this is not your gross pay – this is the amount paid to Brookson for services you have provided under your contract of Employment.

Please note that this is not your gross pay – this is the amount paid to Brookson for services you have provided under your contract of Employment.

2. Calculation of employee gross pay

Before calculating the gross pay, we need to calculate the Employer‘s statutory costs, Employer pension costs and Brookson company margin before calculating your salary. Such costs comprise the following:

Employer Statutory Costs: This figure includes the Employer’s National Insurance and Apprenticeship Levy contributions which must be deducted and paid to HMRC.

Employer Pension: This amount is paid into your pension fund.

Company Margin: This is the only amount retained by Brookson.

Year to date: This column shows your cumulative gross pay details from Brookson, together with cumulative Income tax and Employee’s National Insurance figures on payments received from Brookson. Income Tax and National Insurance are calculated in line with HMRC rules and these amounts are collected by Brookson and paid over to HMRC.

Employer Statutory Costs: This figure includes the Employer’s National Insurance and Apprenticeship Levy contributions which must be deducted and paid to HMRC.

Employer Pension: This amount is paid into your pension fund.

Company Margin: This is the only amount retained by Brookson.

Year to date: This column shows your cumulative gross pay details from Brookson, together with cumulative Income tax and Employee’s National Insurance figures on payments received from Brookson. Income Tax and National Insurance are calculated in line with HMRC rules and these amounts are collected by Brookson and paid over to HMRC.

3. Payslip (funds paid to employee)

Employee Gross Pay (A): This is your gross pay amount after items listed in 2 above.

Earnings: This column shows the components of your gross pay for the pay period:

Salary: This is amount paid for your services -which will never be less than the National Living Wage or Minimum Wage Rate ( determined by your age).

Holiday Pay: This is the money due and paid to you for holidays in this pay period. This is not deducted and retained, but is a payment in advance of holiday leave being taken and means you are constantly up to date with the money you are entitled to for holiday pay.

Holiday pay is calculated at 0.1207% x Salary.

You should keep this amount to one side so it is available to you when you take holiday away from work, as you will not receive any further payments from Brookson whilst you take your annual leave entitlement.

Employee Gross Pay (A): This figure is made up of the above 2 elements.

Salary Sacrifice: If you enter into a salary sacrifice arrangement (for example, a pension salary sacrifice arrangement where you give up part of your salary to fund your pension pot) a deduction is made from employee gross pay so that you benefit from income tax and NI relief on your contribution. Cycle to work scheme payments are included here too.

Total Gross Pay This Period (B): This is your total gross pay for this pay period and is made up of Employee Gross Pay (A) , less any salary sacrifice arrangements, plus any other payments due in the period if applicable (e.g. statutory payments such as SSP).

Deductions (C): These relate to deductions from your total gross pay this period and comprise tax, employees NIC, student loan and employees’ pension deductions (as appropriate).

Net Pay (B-C): Total Gross Pay This Period minus Total Deductions.

Total Paid to Bank Account: This is the amount you will see credited to your bank account for this pay period.

Earnings: This column shows the components of your gross pay for the pay period:

Salary: This is amount paid for your services -which will never be less than the National Living Wage or Minimum Wage Rate ( determined by your age).

Holiday Pay: This is the money due and paid to you for holidays in this pay period. This is not deducted and retained, but is a payment in advance of holiday leave being taken and means you are constantly up to date with the money you are entitled to for holiday pay.

Holiday pay is calculated at 0.1207% x Salary.

You should keep this amount to one side so it is available to you when you take holiday away from work, as you will not receive any further payments from Brookson whilst you take your annual leave entitlement.

Employee Gross Pay (A): This figure is made up of the above 2 elements.

Salary Sacrifice: If you enter into a salary sacrifice arrangement (for example, a pension salary sacrifice arrangement where you give up part of your salary to fund your pension pot) a deduction is made from employee gross pay so that you benefit from income tax and NI relief on your contribution. Cycle to work scheme payments are included here too.

Total Gross Pay This Period (B): This is your total gross pay for this pay period and is made up of Employee Gross Pay (A) , less any salary sacrifice arrangements, plus any other payments due in the period if applicable (e.g. statutory payments such as SSP).

Deductions (C): These relate to deductions from your total gross pay this period and comprise tax, employees NIC, student loan and employees’ pension deductions (as appropriate).

Net Pay (B-C): Total Gross Pay This Period minus Total Deductions.

Total Paid to Bank Account: This is the amount you will see credited to your bank account for this pay period.

More Pay Information

Your Tax Code

This is provided to Brookson by HMRC. If you believe this to be incorrect, please contact HMRC directly on 0300 200 3300 or you can access the online service. Brookson are legally unable to change tax codes without instruction from HMRC.

Your tax code represents the amount of pay you can earn before you pay tax. It is generally based on your personal allowance. The standard personal allowance for 2024/25 is £12,570 which equates to a 1257L tax code.

There may be reasons why your tax code is different, for example, you may have used your personal allowance against another employment.

Your NI letter is determined by your employee group. Category A is a standard category for all employees apart from NI letters which cover other age groups, who are above the pensionable age or under 21, for example.

Your tax code represents the amount of pay you can earn before you pay tax. It is generally based on your personal allowance. The standard personal allowance for 2024/25 is £12,570 which equates to a 1257L tax code.

There may be reasons why your tax code is different, for example, you may have used your personal allowance against another employment.

Your NI letter is determined by your employee group. Category A is a standard category for all employees apart from NI letters which cover other age groups, who are above the pensionable age or under 21, for example.

Holiday pay

This is essentially a payment in advance of the holiday pay and means that you are constantly up to date with the money you are entitled to for holiday pay.

What is your entitlement?

Employment Law states you are entitled to take 28 working days (or 5.6 weeks) of paid holiday in each holiday year. Brookson’s holiday year runs from 6th April to 5th April. Your entitlement is inclusive of your entitlement to public and statutory bank holidays recognised in England and Wales. If you work variable hours your holiday entitlement will be calculated on a pro rata basis. If your employment commenced or terminates part way through the holiday year, your entitlement to holidays during that holiday year will be assessed on a pro rata basis. Unused holidays may not be carried forward into the next holiday year. We would like to kindly remind you that it is your responsibility to ensure that you take your full holiday allowance throughout the year, as it is important that you do so, otherwise it may be lost.

You must give Brookson as much notice as possible of your intention to take holidays, but no less than twice the amount of holiday time to be taken. It is also your responsibility to advise Brookson if a client or an intermediary agency refuses to allow you to take leave whilst you are on an assignment.

How is Holiday Pay calculated and paid?

You holiday pay is calculated based on the gross taxable pay you receive during your employment with Brookson. Your gross taxable pay consists of your minimum wage payment and bonus.

The holiday allowance for 2024/25 is calculated as follows:

5.6 weeks ÷ 46.4 weeks = 12.069% (note: 28 days = 5.6 weeks).

This is the percentage of your gross taxable pay we include in your weekly pay. This is shown on your payslip as “Holiday pay”.

What is your entitlement?

Employment Law states you are entitled to take 28 working days (or 5.6 weeks) of paid holiday in each holiday year. Brookson’s holiday year runs from 6th April to 5th April. Your entitlement is inclusive of your entitlement to public and statutory bank holidays recognised in England and Wales. If you work variable hours your holiday entitlement will be calculated on a pro rata basis. If your employment commenced or terminates part way through the holiday year, your entitlement to holidays during that holiday year will be assessed on a pro rata basis. Unused holidays may not be carried forward into the next holiday year. We would like to kindly remind you that it is your responsibility to ensure that you take your full holiday allowance throughout the year, as it is important that you do so, otherwise it may be lost.

You must give Brookson as much notice as possible of your intention to take holidays, but no less than twice the amount of holiday time to be taken. It is also your responsibility to advise Brookson if a client or an intermediary agency refuses to allow you to take leave whilst you are on an assignment.

How is Holiday Pay calculated and paid?

You holiday pay is calculated based on the gross taxable pay you receive during your employment with Brookson. Your gross taxable pay consists of your minimum wage payment and bonus.

The holiday allowance for 2024/25 is calculated as follows:

5.6 weeks ÷ 46.4 weeks = 12.069% (note: 28 days = 5.6 weeks).

This is the percentage of your gross taxable pay we include in your weekly pay. This is shown on your payslip as “Holiday pay”.

Pension costs

If you have elected to join the Brookson pension scheme, the employer’s contributions are recorded here.

Further information in respect of pensions can be found in FAQ’s

Further information in respect of pensions can be found in FAQ’s

Employer Statutory costs (Apprenticeship Levy and Employer’s NI only)

This is the amount of Employer’s National Insurance (13.8% above the secondary threshold) and Apprenticeship Levy (0.5%) which Brookson must pay based on your employee gross pay.

Company margin

This is the amount which is retained by Brookson to cover our costs and contribute to our profit.